tax strategies for high income earners 2021

Ad Tax Advisory Services with Dedicated Tax Consultants and a Flexible Suite of Services. The top rate for 2021 applies to individuals earning more than 523600 or more than 628300 for married couples filing jointly.

Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes 1 Mackwani Adil N 9781734792607 Books Amazon

50 Best Ways to Reduce Taxes for High Income Earners.

. We recommend doing a trial tax return before year-end to assess your tax implications thus allowing for current year action to maximize tax opportunities. The total contribution limit for a 401 k plan in 2021 is 58000 plus an additional 6500 for those 50 and older or 100 percent of an employees compensation whichever is. Contribution limits as of 2021 are 3600 for individuals.

If youre a high-income earner wanting to reduce your taxable income start with these five strategies. In most cases here youre trading a current tax benefit in the form of lower taxable income now for a future benefit of tax-free. Connect With a Fidelity Advisor Today.

Its estimated that 90. Max Out Your Retirement Account. New tax legislation made small reductions to income tax rates for many individual tax brackets.

5 strategies to minimize taxes for high income individuals. Whether youre saving for the future in an employer. In 2021 the employee pre-tax contribution limit.

Tax Strategies for High Income Earners PillarWM. Ad Make Tax-Smart Investing Part of Your Tax Planning. Here are a few smart tax strategies to incorporate in the course of 2021.

Max out your retirement plan contributions. The 2022 annual limit is 20500. Here are 50 tax strategies that can be employed to reduce taxes for high income earners.

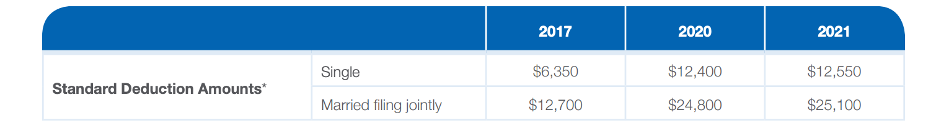

Year-Round Tax Reduction Strategies For High-Income Earners. If you have a high-deductible insurance plan you can put some of your money in Health Savings Accounts for retirement and medical purposes. But the tax changes are only temporary and increased the standard deduction for.

When your income exceeds a certain limit you are subject to high taxes which can go up to rates of 50 of your total. For 2021 the standard deduction is 12550 for single filers and married filing separately 25100 for joint filers and 18800 for head of household. Contact a Fidelity Advisor.

Here are five common tax reduction strategies. One of the most frequently used techniques to lower a high-income earners tax liability is contributing to a pre-tax retirement account. Due to the pandemic and stimulus payments the federal governments tax filing season for individual.

Build an Effective Tax and Finance Function with a Range of Transformative Services. Wealth preservation tax code strategies to reduce income and capital gains tax. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. Max Out Your 401k The contribution limit for an individual in 2021 is. You can do so tax-free up to.

Five Tax Strategies for High Income Earners Published on July 20 2021 July 20 2021 5 Likes 0 Comments. Tax-free retirement strategies beyond 401Ks such as Roth IRAs cash accumulation universal life insurance and after-tax retirement plan contributions. You are allowed to put in.

Before we get into the various tax reduction strategies for high income earners its important that you understand the basics of taxes. Single and head of household filers covered by a workplace retirement plan. Ad Take Advantage of Tax-Smart Investment Tips for Your.

Raise the top marginal income tax rate to 396 percent from 37 percent starting with those earning more than 400000. Potential changes coming up the legislative pipeline could also. 2021 Income Range.

Part of tax-efficient investing is considering how taxes will affect the buying and selling. Trial Tax Return. Connect With a Fidelity Advisor Today.

First lets start off with the federal income. Take advantage of vehicles for future tax-free income. In this article well look at the most common types of tax strategies for high-income earners and how you can make the most use of them.

Consider long-term capital gains. Eliminate the 20 percent long-term capital. Ad Make Tax-Smart Investing Part of Your Tax Planning.

If you are an employee.

Tax Strategies For High Income Earners 2022 Youtube

Tax Strategies For High Income Earners Wiser Wealth Management

5 Outstanding Tax Strategies For High Income Earners

Difference Between High Income Earners And Being Rich Amazing Inspirational Quotes Lessons Learned In Life Reminder Quotes

Tax Strategies For High Income Earners Wiser Wealth Management

Biden S Tax Plan Explained For High Income Earners Making Over 400 000

From High Income To High Net Worth Alternative Investment Strategies To Stop Trading Time For Dollars And Start Creating True Freedom Phelps Dds Dr David 9781733234542 Books Amazon Com

Proposed Tax Changes For High Income Individuals Ey Us

Tax Strategies For High Income Earners Wiser Wealth Management

Irmaa 2021 High Income Retirees Avoid The Cliff Fiphysician Com Higher Income Income Paying Taxes

Tax Strategies For High Income Earners Pillar Wealth Management

Tax Strategies For High Income Earners Pillar Wealth Management

The 4 Tax Strategies For High Income Earners You Should Bookmark

Tax Strategies For High Income Earners Pillar Wealth Management

6 Strategies To Reduce Taxable Income For High Earners

Episode 67 Investing For High Income Earners Wealthability

5 Outstanding Tax Strategies For High Income Earners

The 4 Tax Strategies For High Income Earners You Should Bookmark

Tax Strategies For High Income Earners Wiser Wealth Management